All through the 2024 Presidential campaign, some pundits, more on the right than the left, would report what the betting markets were saying. I believe betting markets have gradually been shown to actually be at least as accurate as most polling companies, many of which, especially if affiliated with a partisan leaning legacy media organization, seem to produce results that are what they want to hear or want voters to believe.

But now we know the result: Donald Trump was elected President. And he immediately began firing fedcrats, making appointments, tweeting, issuing Executive Orders, and enacting policies. Most of his fans on X say he is doing more and doing it faster than they had hoped for. Conservative pundit Hugh Hewitt opined: “The question the Democrats and legacy media should be asking themselves: If the 2024 election was held again this Tuesday with the public fully informed of President Trump’s actions and personnel selections from his first month, how much bigger would his very big win become? I suspect at least NJ would have been added to the pile. Perhaps more.” Even solidly right-wing writers like David Marcus say they underestimated Donald Trump’s superior mind for strategery: “Another way to look at that is that when Patel, RFK Jr, Hegseth, etc were nominated the assumption was, and I may have shared it to some degree, that those choices would spend political capital. Just the opposite happened.”

Some attribute the speed of Trump’s opening volley to “tech advisor” Elon Musk, who is operating on the Silicon Valley maxim that you should “move fast and break things.” Initially Democrats were paralyzed, unable to respond to the huge number of policies being thrown at them every day. Capitol Hill Democrats still seem to be unable to do much more than sing out of tune folk songs and recruit blue haired, septum pierced hippos to scream and march. The optics may be what is driving more and more voters to re-register as Republicans, independents, or any choice other than Democrat.

But Democrat judges and lawfare NGOs, the latter being the people whose grants and subsidies are getting the axe, eventually stepped up with vollies of their own, injunctions arguing that the Chief Executive may not manage Executive agencies, their budgets, and staff.

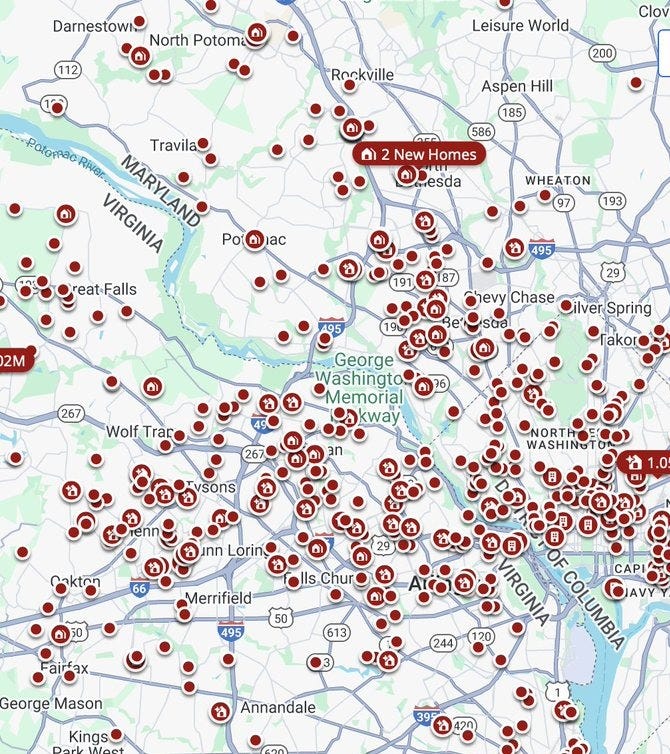

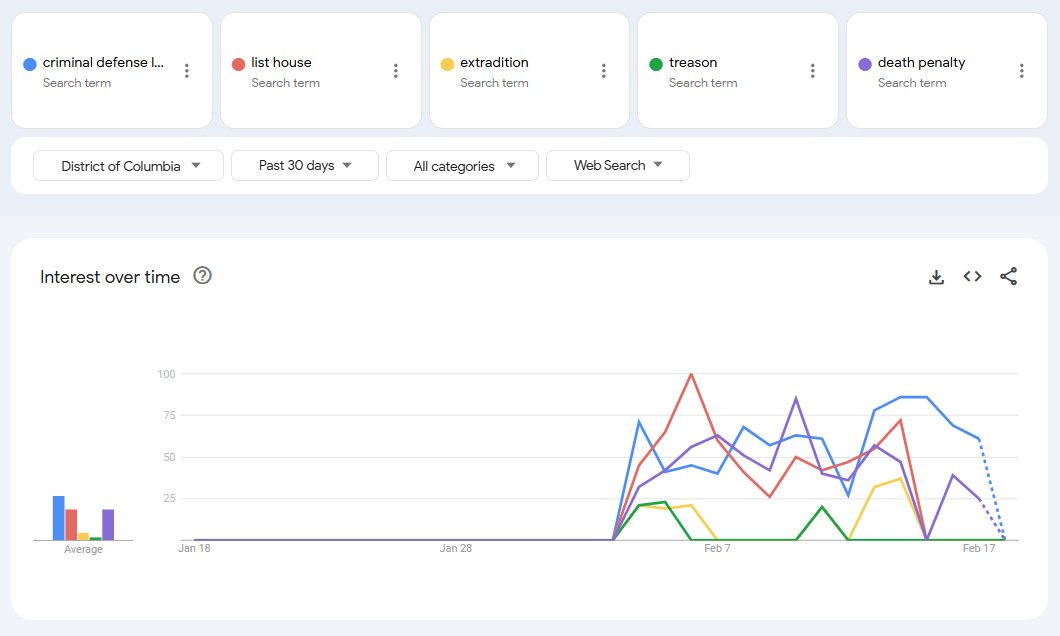

We could turn to the betting markets to see what they predict about this conflict. But we actually have another market giving us an answer and telling us what the DC bureaucrats themselves predict: the DC real estate market. Indeed a few right of center pundits and X accounts have all begun reporting that DC real estate is collapsing, with Rasmussen’s Mark Mitchell circulating a graph that showed a Zillow zestimate image of the average DC home value collapsing in the past month from almost $900,000 to $750,000 and others circulating images of the thousands of properties for sale in the DC metro area. The right’s pre-eminent humorist, Peachy Keenan, wondered if she could trade her home in fire ravaged SoCal for that of some fleeing DC fedcrat: “Maybe I can trade with one of these suckers - they get to live in the city their policies wrecked, I get to live in the imperial capital.”

Looking at data in the local multiple listing system (Bright MRIS) for the DC area supports the claim that inventory has grown is true. There were slightly over 6,000 residential properties on the market in the DC metro area as compared to 4900 in January 2024 and 5100 in January 2023. But so far prices are continuing to go up. It may be that seeing how February year-to-year data compares will be more probative. (To get out ahead of this story, Bright issued a press release claiming early February 2025 numbers don’t differ from February 2024.) In my own office a realtor tells me she is putting her northern Virginia condo on the market this week and asks me “What is going to happen to us?”

There are three other complicating factors for those excited about panic in Panem:

Washington, D.C. lost 50,000 residents during Covid, as fedcrats shifted to telework, DC crime rates spiked, rodent populations and homeless camps expanded, and DC had more punitive and longer lasting lockdown policies than surrounding areas (which often gained slightly in population).

High interest rates had kept sellers from putting inventory on the market for over a year. Rates have been dropping slightly since late last year, leading more sellers to believe they could find a buyer who could meet their listing price and that they themselves could afford a loan if they needed one for their next home.

As one real estate team points out, the DC metro area has many jurisdictions that move in different directions. Currently Washington, D.C. and close in Arlington County, Virginia do have expanding inventory and slowly falling prices. But most other suburban areas are not seeing panic. Yet.

Back in 2009 I sold a number of people houses they could otherwise not have afforded because prices in some areas - outside the Beltway (the highway that circles Washington, D.C.) and far from subway stops - collapsed to 60% of their 2006-2008 levels, after the mortgage crisis. But my customers were people who often worked for federal agencies like the National Science Foundation, the EPA or the Department of Justice. Who could buy in the DC area if Trump really cut the federal workforce and property dropped again to 60% or less of current prices - including property inside the Beltway? DC is short on industries that are not related to government. Journalists, contractors, lobbyists are all here because of the federal government. One possibility is that at low enough prices, the DC area could become home to a much larger number of 55+ communities, and retirees could enjoy the Blue Ridge mountains, the Chesapeake Bay, Virginia wine country, and DC’s many museums and hospitals. Perhaps the gerontocrats on the Hill could just stay here after retirement.

Next month’s inventory data should make it clearer what is going to happen.

A version of this was published this week at American Thinker.